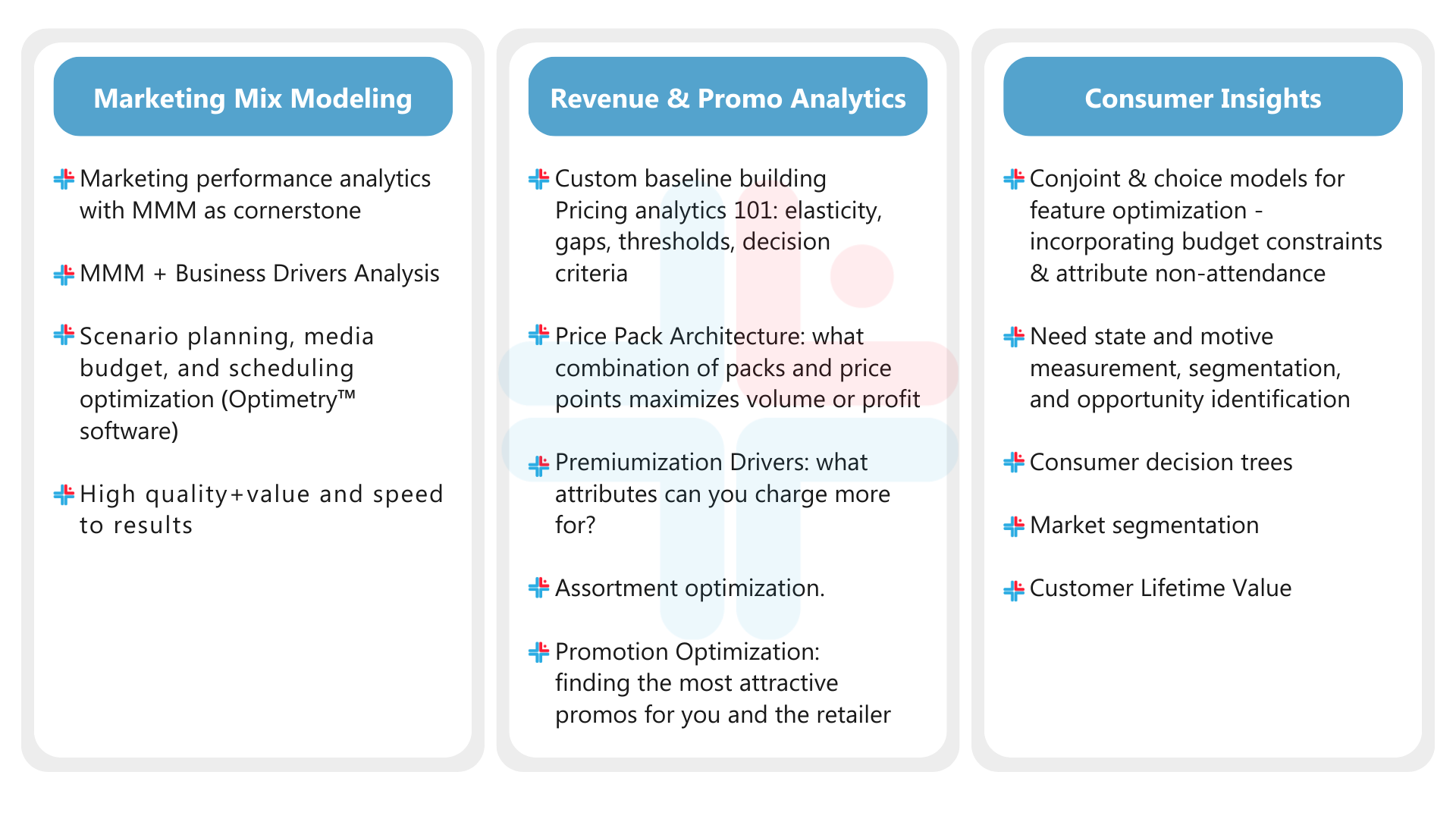

For the Consumer Packaged Goods (CPG) industry, a lot of focus in marketing analytics is placed on things like marketing mix modeling, consumer behavior, and brand strategy. But there’s another crucial piece that often doesn’t get as much attention: the role of trade and distribution in driving business outcomes. These aren’t just logistical details—they’re powerful factors that can significantly influence a brand’s performance in the market.

As someone who works closely with CPG companies, I’ve seen how important trade and distribution strategies are to a brand’s success. Activities like in-store promotions, price discounts, and product placement deals directly impact what consumers buy. Similarly, the distribution model a company uses can either enhance or limit its ability to get products on shelves and into customers’ hands. These factors are often the unsung heroes behind a brand’s market share and overall profitability.

The Importance of Distribution Models

One distribution approach worth highlighting is Direct Store Delivery (DSD). For those who aren’t familiar, DSD involves delivering products directly to retail stores instead of going through distribution centers. This allows companies to have more control over how their products are displayed and stocked, which can lead to fresher products on the shelves and a quicker response to what the market wants.

However, DSD isn’t without its challenges. Running a DSD operation is more complex and demanding than traditional distribution methods. It requires close attention to everything from delivery schedules to shelf space and product availability. But for companies that can manage these challenges, the benefits are clear. The extra control that DSD provides can lead to better sales and a stronger presence in stores.

Modeling Trade and Distribution in Marketing Analytics

Given how important trade and distribution are to the success of CPG brands, it’s critical that these factors are accurately reflected in marketing mix models (MMM). Unfortunately, many MMM practices focus more on media and advertising, often leaving trade and distribution underexplored. This is a missed opportunity, especially for companies using complex distribution methods like DSD.

To truly understand the impact of trade and distribution on business outcomes, it’s important to use a modeling approach that matches the level of detail involved in these areas. This is where Hierarchical Bayesian models come in. These models are particularly good at handling the complexity and detail required to accurately represent trade and distribution activities in MMM.

Hierarchical Bayesian models allow us to combine different levels of data—like store-level sales, regional distribution patterns, and national trade activities—into one cohesive framework. This level of detail ensures that the model captures the true drivers of business performance, providing more accurate and actionable insights. For CPG companies using a DSD model, this level of detail is not just helpful—it’s essential.

The Takeaway for CPG Brands

For CPG brands, especially those using complex distribution methods like DSD, it’s important that your marketing analytics efforts don’t overlook the impact of trade and distribution. While media and advertising are important, they’re just one part of the story. To really understand and improve your brand’s performance, your MMM should reflect all the factors that drive your business, including trade and distribution.

By using advanced modeling techniques like Hierarchical Bayesian models, you can make sure that your analytics are as detailed and accurate as your business operations. This won’t just lead to better insights—it will help you make decisions that drive real growth.

Trade and distribution deserve more attention in marketing analytics. These elements are crucial to the success of CPG brands, and their impact should be fully accounted for in any comprehensive marketing mix model. As the CPG landscape continues to change, those who can navigate the complexities of trade and distribution will be the ones who succeed.

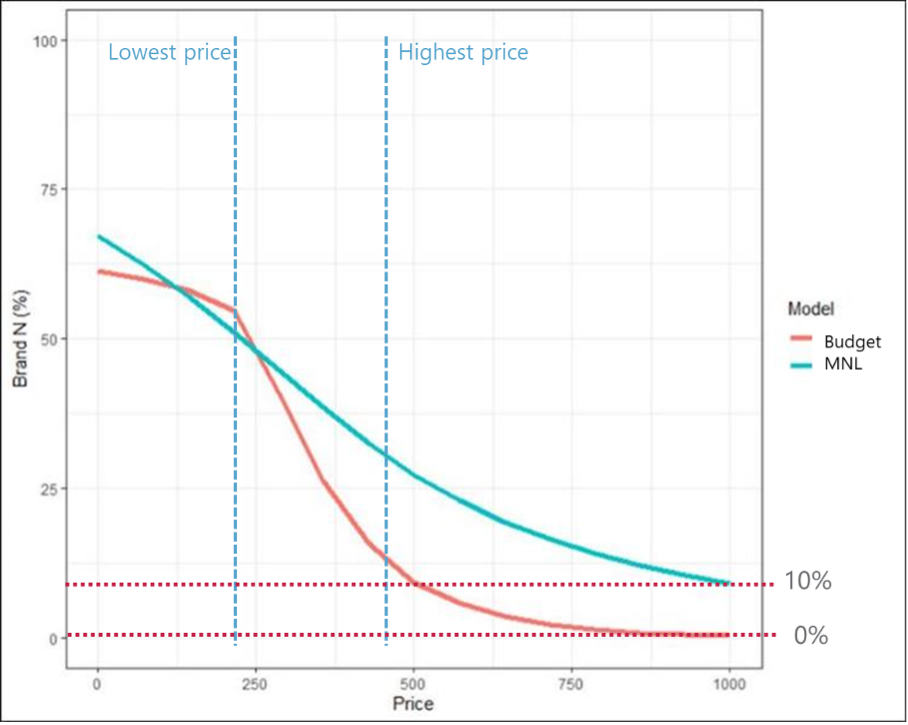

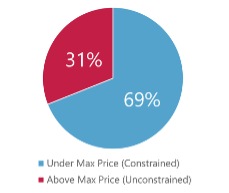

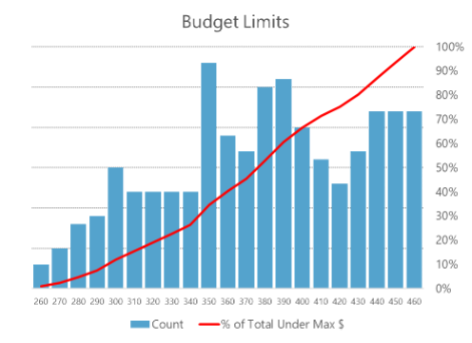

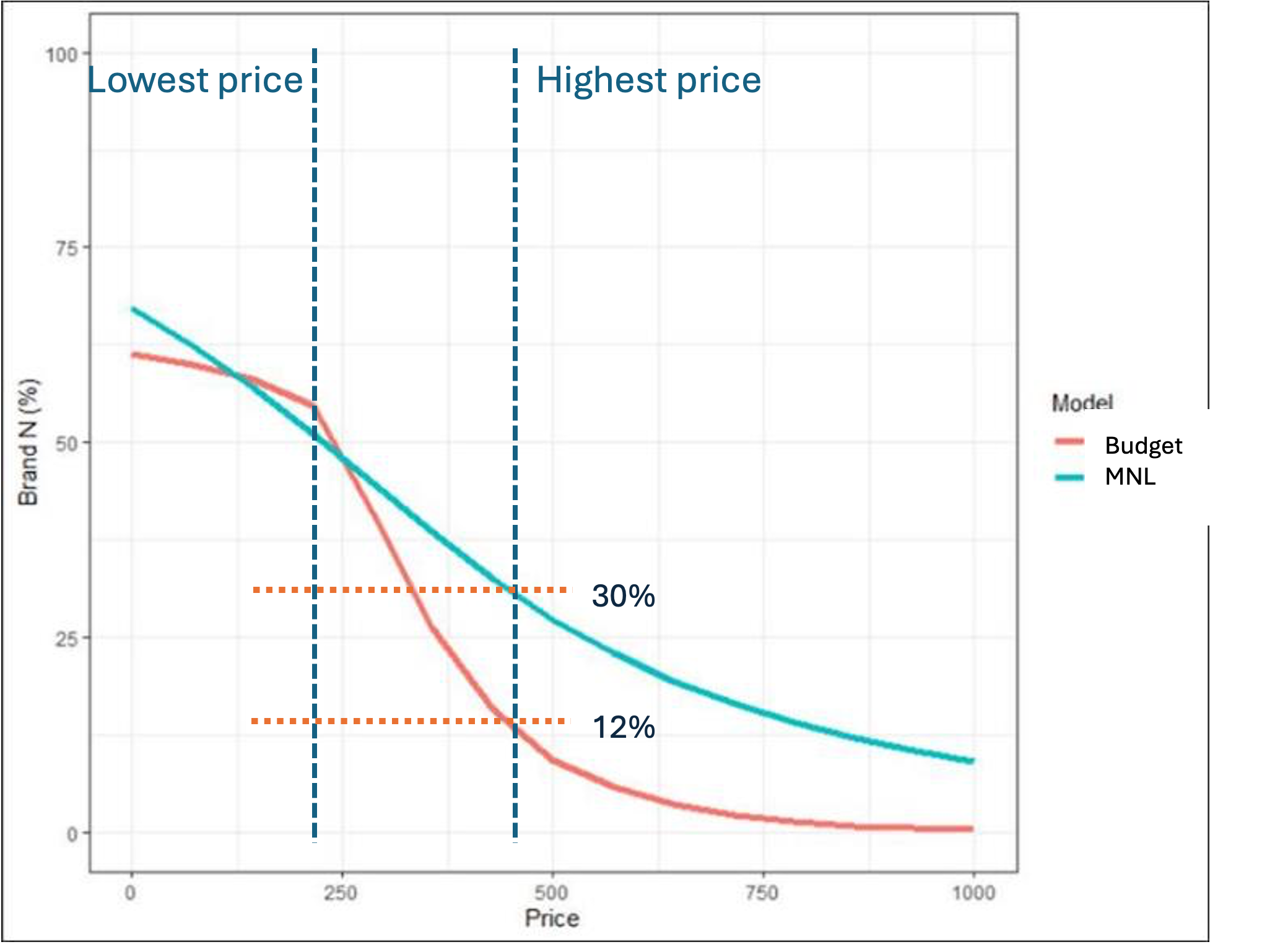

When the price exceeds their budget; the product becomes unaffordable and they “drop out” of buying that camera.

When the price exceeds their budget; the product becomes unaffordable and they “drop out” of buying that camera.